Understanding How Much Section 8 Assistance Pays Today

If you’ve ever wondered How Much Does Section 8 Pay toward rent in the United States, the answer lies in a federal system designed to help low-income households afford private rental housing. The Section 8 Housing Choice Voucher Program subsidizes part of tenants’ rent by paying the difference between what a family can afford and the local market cost of housing. This article explains how the payment system works in 2026, how much subsidy participants may receive, and what factors influence payments.

CTA: Stay with us for a clear, practical guide on Section 8 rent assistance and what to expect from the housing subsidy system.

What the Section 8 Program Actually Covers

The Section 8 Housing Choice Voucher Program is administered by local Public Housing Authorities (PHAs) and funded by the U.S. Department of Housing and Urban Development (HUD). The goal is to ensure that low-income families, the elderly, and people with disabilities can afford decent, safe housing in the private rental market.

The basic structure of how much a household pays and how much Section 8 covers is simple:

- A household pays about 30% of its adjusted monthly income toward rent and utilities.

- The program calculates a “payment standard” based on local fair market rents (FMRs).

- HUD (through the PHA) then pays the rest of the rent up to that payment standard.

This means Section 8 doesn’t pay a fixed national amount. Rather, it pays up to a locally determined maximum, and your personal share depends on your income and household size.

How Payment Standards Work Across Different Areas

Each public housing authority sets a payment standard that reflects local rental costs. These standards are typically tied to HUD’s Fair Market Rents (FMRs), which represent the cost of modest rental housing in that community.

Examples of Payment Standards in 2026

Here’s how local payment standards can vary widely across the U.S.:

- In New York City, a 2026 schedule shows:

- Studio: ~$2,646

- 1-Bedroom: ~$2,762

- 2-Bedroom: ~$3,058

- 3-Bedroom: ~$3,811

- 4-Bedroom: ~$4,111

- Larger units up to nearly $6,580 for 8 bedrooms.

- Seattle housing authorities report payment standards such as:

- Studio: ~$2,042

- 1-Bedroom: ~$2,100

- 2-Bedroom: ~$2,455

- 3-Bedroom: ~$3,297

- 4-Bedroom: ~$3,847

- 5-Bedroom: ~$4,424

- 6+ Bedrooms: ~$5,001

(Market rate figures.)

- Other local HPAs publish their own ranges, like:

- Lucas County, Ohio (example): 0-BR ~$846, 1-BR ~$902, 2-BR ~$1,184, up to 6-BR ~$2,079.

- Newark, New Jersey: Studio ~$1,612, 1-BR ~$1,822, 3-BR ~$2,761, 6-BR ~$4,078.

- District of Columbia standards exceed $7,000 for very large units (over 5 bedrooms).

These numbers show how rental subsidies can vary significantly depending on where you live. Areas with higher rents naturally have higher payment standards.

Exactly How Much You’ll Receive Depends on Your Income

After determining the local payment standard, the actual subsidy is calculated like this:

- The housing authority determines how much rent the tenant can afford (about 30% of adjusted income).

- They compare that to the lesser of:

- The rental unit’s contract rent plus utility allowance, or

- The payment standard for that unit size in that area.

- The housing authority pays the difference between what the tenant can afford and the approved rent, up to the payment standard.

For example, if your rental unit’s contract rent is $2,000/month, and your share (30% of income) is $600, HUD’s housing assistance payment might be ~$1,400 if the payment standard covers that amount. If the rent exceeds the payment standard, you may need to cover the difference.

Factors That Influence How Much You Receive

Income and Household Size

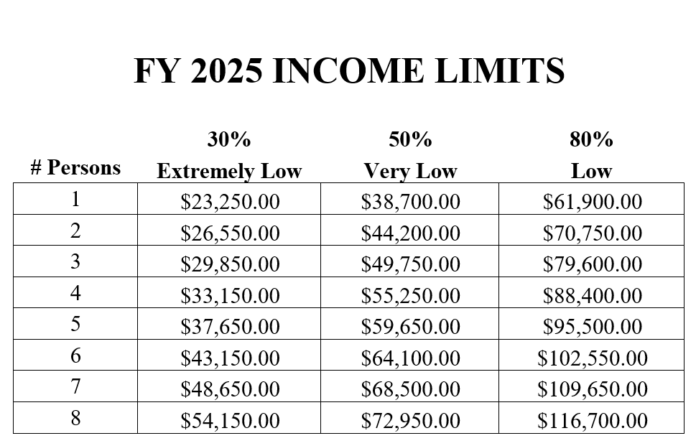

Section 8 participants must have incomes below certain limits to qualify. These limits are set by HUD but vary by area and family size. For example, extremely low and very low-income ceilings will differ across counties.

Larger households generally qualify for vouchers covering larger units, which tend to have higher payment standards.

Local Rent Levels and Fair Market Rents (FMRs)

Since payment standards are based on HUD’s FMRs, they change annually. HUD’s 2026 FMRs took effect in fall 2025 and factor in local housing cost trends.

Public housing authorities often set standards between 90% and 110% of the area’s FMRs, meaning they can adjust up or down within that range to align with actual rents.

Utility Allowances

Most programs include utility allowances – estimated monthly utility costs tenants must pay directly. Authorities adjust payment standards to include these housing costs.

What Section 8 Does Not Pay

Section 8 does not cover the entire rent unless your income is extremely low and rents match local standards. If a landlord charges more than the payment standard, tenants must pay the extra portion themselves.

Also, tenants may face additional costs like deposits or fees not covered by vouchers.

Common Misconceptions About Section 8 Payments

It Pays a Flat Amount

No — payment amounts are individualized. You won’t simply receive a standard monthly check; rather, the subsidy is paid directly to your landlord.

Everyone Pays Only 30% of Income

30% is the general target, but real payments can vary with deductions, utility allowances, and household adjustments.

Tips for Applicants and Participants

- Check Local Payment Standards: Contact your local housing authority to know precise numbers where you live.

- Understand Rent Reasonableness: PHAs must ensure rents are comparable to local market rents.

- Plan for Differences: If rent is above the payment standard, expect to pay the extra.

We hope this breakdown helps you understand how Section 8 housing payments work and what you may expect based on your income and community rental costs. If you have questions or personal experiences, share them below — we’d love to hear your thoughts!